Budgeting serves as the cornerstone of financial health, providing individuals with a clear framework to manage their income and expenses. At its core, a budget is a plan that outlines how much money is available for spending and saving over a specific period. This practice not only helps in tracking where money goes but also fosters a sense of control over one’s financial situation.

By understanding income sources and expenditure patterns, individuals can make informed decisions that align with their long-term financial goals. Moreover, budgeting is essential for cultivating financial discipline. It encourages individuals to prioritize their needs over wants, leading to more thoughtful spending habits.

For instance, someone who budgets may choose to forgo an expensive dinner out in favor of saving for a vacation or paying off debt. This shift in mindset can significantly impact one’s financial stability and overall well-being, as it reduces stress associated with financial uncertainty and promotes a more secure future.

Key Takeaways

- Understanding the importance of budgeting is crucial for financial stability and achieving long-term goals.

- Creating a realistic and achievable budget involves tracking expenses, setting priorities, and making necessary adjustments.

- Cutting expenses without sacrificing enjoyment can be achieved through smart shopping, meal planning, and finding free or low-cost activities.

- Finding creative ways to save money includes DIY projects, using coupons, and taking advantage of loyalty programs.

- Setting and achieving financial goals requires discipline, consistency, and periodic reassessment of progress.

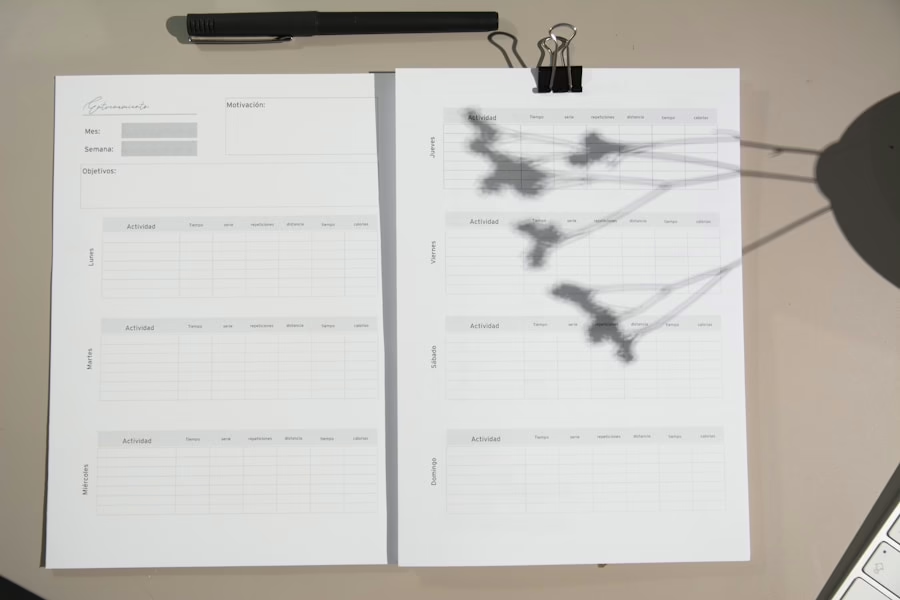

Creating a Realistic and Achievable Budget

Gathering Financial Information

The first step involves gathering all relevant financial information, including income, fixed expenses (like rent or mortgage), variable expenses (such as groceries and entertainment), and any debts.

Setting Achievable Goals

A well-structured budget should reflect not only current financial obligations but also personal values and lifestyle choices. It is crucial to set achievable goals within the budget framework. For example, rather than aiming to cut all discretionary spending immediately, one might start by reducing it by a specific percentage each month.

Creating a Practical Budget

This gradual approach allows for adaptation and minimizes the risk of feeling deprived. Additionally, incorporating a buffer for unexpected expenses can prevent the budget from becoming overly restrictive, ensuring that it remains a practical tool rather than a source of frustration.

Tips for Cutting Expenses without Sacrificing Enjoyment

Cutting expenses does not have to equate to sacrificing enjoyment; rather, it can lead to discovering new ways to appreciate life on a budget. One effective strategy is to reassess recurring subscriptions and memberships. Many individuals find themselves paying for services they rarely use, such as streaming platforms or gym memberships.

By evaluating these expenses and canceling those that do not provide significant value, one can free up funds for more meaningful experiences. Another approach involves embracing the concept of mindful spending. This means being intentional about purchases and seeking alternatives that provide similar satisfaction at a lower cost.

For instance, instead of dining out frequently, one might explore cooking at home with friends or family, turning meal preparation into a social event. Such activities not only save money but also foster connections and create lasting memories, demonstrating that enjoyment can thrive even within a budget.

Finding Creative Ways to Save Money

Creativity plays a vital role in the art of saving money. Individuals can explore various avenues to cut costs while still enjoying life’s pleasures. One popular method is utilizing community resources, such as local libraries or community centers, which often offer free events, workshops, and access to books and media.

Engaging with these resources can provide entertainment and education without the associated costs of commercial alternatives. Additionally, individuals can tap into their hobbies as a means of saving money. For example, someone who enjoys crafting can create personalized gifts instead of purchasing them, while those with gardening skills might grow their own vegetables to reduce grocery bills. These creative outlets not only save money but also enhance personal fulfillment and satisfaction, proving that frugality can be both enjoyable and rewarding.

Setting and Achieving Financial Goals

Setting clear financial goals is essential for maintaining motivation and direction in budgeting efforts. These goals can range from short-term objectives, such as saving for a vacation or paying off credit card debt, to long-term aspirations like buying a home or funding retirement. By defining specific, measurable, achievable, relevant, and time-bound (SMART) goals, individuals can create a roadmap that guides their budgeting decisions.

Once goals are established, tracking progress becomes crucial. Regularly reviewing one’s financial situation allows for adjustments to be made as needed. For instance, if an individual finds they are consistently exceeding their entertainment budget, they may need to reassess their spending habits or adjust their goals accordingly. Celebrating milestones along the way such as reaching a savings target can also provide motivation and reinforce positive financial behaviors.

Overcoming Challenges and Staying Motivated

Allowing for Indulgences

This means allowing for occasional indulgences while remaining committed to your overall financial goals. Acknowledging that setbacks are part of the journey can help you stay focused on long-term success rather than becoming discouraged by temporary difficulties.

Staying Motivated

Staying motivated requires ongoing reflection on the reasons behind your budgeting efforts. Regularly revisiting your personal financial goals and visualizing the benefits of achieving them – such as reduced stress or increased savings – can reignite your enthusiasm for budgeting.

Seeking Support

Additionally, seeking support from friends or family members who share similar financial aspirations can create a sense of accountability and encouragement, making the journey toward financial stability more enjoyable.

The Benefits of Living within Your Means

Living within one’s means offers numerous benefits that extend beyond mere financial stability. One of the most significant advantages is the reduction of stress associated with financial uncertainty. When individuals adhere to a budget and avoid overspending, they often experience greater peace of mind knowing they are not accumulating debt or living paycheck to paycheck.

This sense of security can lead to improved mental health and overall well-being. Furthermore, living within one’s means fosters a greater appreciation for what one has. By prioritizing needs over wants and making conscious spending choices, individuals often find joy in simple pleasures rather than material possessions.

This shift in perspective can lead to more meaningful experiences and relationships, ultimately enriching one’s life beyond monetary considerations. In essence, embracing a lifestyle of frugality not only supports financial goals but also cultivates a deeper sense of fulfillment and happiness.